Question:

Owner added his daughter to title 10 years ago as a joint tenant. Owner has lived in the property for entire time as sole occupant. The daughter lives in her own property with her family. Owner passes away, title automatically reverts to just daughter. Daughter sells property.

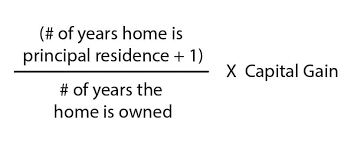

Is capital gains tax due on the 10 years, or just the time she owned the property alone.

Answer:

The daughter assuming that she was over the age of 18, mentally competent and not otherwise dependent upon the father would likely have acquired the property subject to a trust to hold it on behalf of her father for his benefit, not hers. This is based upon the principle of “resulting trust”.

The Supreme Court of Canada addressed this issue in Pecore v. Pecore and Madsen Estate v. Saylor.

Certainly, that need not be the case, and in every situation, the matter should be addressed, so it will be clear that the principle of resulting trust applies or it doesn’t.

This should be set out in a Statement of Intention with respect to the Joint Tenancy tile arrangement.

- The daughter is to receive the title on her own account, or

- The daughter is to receive the title, for the father’s estate. The arrangement was simply chosen to expedite matters and save on the estate administration tax (probate fees).

Here, there is a good argument to the effect that the principal residence exemption applies, notwithstanding the ownership transfer. That would mean that the entire gain, start to finish is exempt from tax. But, without proper documentation, the CRA may come up with the contrary argument. Simply defending the matter itself could be expensive!

Brian Madigan LL.B., Broker