Agreements often start out with the wrong people involved, or not enough of the right people.

For some reason, this issue seems to create some complications. How do you add a new buyer? How do you get rid of the old buyer? What options are available?

From time to time it’s necessary to add a new party, and sometimes the first buyer is to remain and other times the first buyer is to be relieved of their obligations.

Let’s consider two situations. Bob buys a downtown condo from ABC Condo Developers. The property is under construction, he pays the additional deposits, and meets Mary. The occupancy date rolls around and they both move into the condo. On closing, he would like Mary to be on title.

In our second situation, Bob and Mary would like to buy a house. Bill comes along and he would like to buy the condo. It’s gone up in value over the three years of construction. He is willing to pay the increased price. But, the original deal has not been closed.

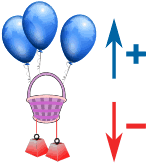

The choices are somewhat limited:

1) A Direction re: Title,

2) An Amendment to the Original Agreement,

3) A Three Party Assignment of the Original Agreement,

4) A Two Party Assignment of the Original Agreement.

A Direction re: Title

In this case, Bob goes to his lawyer and tells the lawyer that he would like Mary to be on title as well. The lawyer prepares a Direction and sends it to the developer’s lawyer.

The conveyance is drawn in favour of Bob and Mary. If, for some reason, the transaction fails to close, Mary has no rights. It is only Bob and ABC who can sue one another.

If for some strange reason, ABC refuses to follow the Direction, then title could be registered directly in the name of Bob, and then Bob could prepare a conveyance of the property in favour of himself and Mary. The only issue is the Land Transfer Tax. Bob paid the tax on closing, and Mary will have to pay tax once she registers the Transfer. If they were married, the conveyance would be for nominal consideration, and no additional tax would be payable, however, if they are not married then they will have to find another way to avoid the duplicity of the tax. There are still some options here.

This solution is the least complicated. As long as Mary doesn’t need to be part of the agreement and be in a position to enforce the agreement against ABC Developers, then this will work.

You will appreciate that generally this is satisfactory when it comes to Mary’s situation. Bob will sue if he has to.

In Bill’s situation, again it works appropriately. But, really Bill would prefer to have the right to sue ABC directly should there ever be an issue. So, this particular approach, while “quick and dirty” is not really the preferred solution. Bill’s ability to get Bob to co-operate with any lawsuit “after the fact” is likely minimal.

An Amendment to the Original Agreement

This solution is designed to add Buyer #2, to the original agreement. It would be better for Mary, particularly if she is coming up with her own money to be invested in this property. Also, it is better for Bill.

This way, Bob and Bill sign an Amendment Agreement, stating the following:

1) Bill agrees to become a party to the agreement, from the beginning,

2) Bob agrees that Bill will be a party,

3) Bob agrees that the deposits paid will now be owned by both himself and Bill equally,

4) ABC Condo Developers agree that Bill will be a party to the agreement (usually phrased as a condition).

The Amendment Agreement is now submitted to ABC Condo Developers for execution, and once it has been signed, it is binding upon all three parties.

Naturally, there could be other issues which are included. But, in essence, in order to have an enforceable agreement by Bill, we need to add him as a party to the Original Agreement.

A Three Party Assignment of the Original Agreement

This is another approach and it is slightly more sophisticated. It works in Mary’s situation but it could be “overkill”.

However, it is really the right approach when Bill is an independent third party. Bob lists and sells his condo. Well, actually he can’t do that. It’s not finished and there’s no such thing as real estate “in the air”. When the entire project is finished ABC Condo Developers can register under the Condominium Act. That means that they can convey the property. Until then, they are stuck and Bob is stuck, unless he can assign the Contract. While he does not have real estate, he does have a “chose-in-action”, that is, an entitlement which is capable of conveyance.

The proper way to convey this asset is by way of an Assignment of the original Agreement of Purchase and Sale. Bob and Bill sign an Assignment Agreement, stating the following:

1) Bob assigns the original Agreement to Bill,

2) Bob agrees that the deposits paid will now be owned by Bill,

3) Bill agrees to complete the transaction as Bob had initially agreed,

4) ABC Condo Developers agree that Bill will be a party to the agreement (usually phrased as a condition).

The Assignment which is now a two party agreement is submitted to ABC Condo Developers for approval, and consent.

ABC Condo Developers agree that Bill will be a party to the agreement. Once signed, it becomes a three party agreement.

A Two Party Assignment of the Original Agreement

In this situation ABC Condo Developers has already indicated that it will not agree to any assignments. This does not mean that contract cannot be assigned. It just means that ABC will not go along with it. ABC wishes to complete the transaction as it stands. To some extent, it may be hoping that Bob does not have the funds to close (thereby keeping the deposits). And, this may be true, but Bill does.

The proper way to convey this property without ABC’s involvement is by way of an Assignment of the original Agreement of Purchase and Sale. Bob and Bill sign an Assignment Agreement, stating the following:

1) Bob assigns the original Agreement to Bill,

2) Bob agrees that the deposits paid will now be owned by Bill,

3) Bob agrees in the capacity of trustee to complete the transaction on behalf of Bill (beneficiary) as Bob had initially agreed.

In this circumstance, Bill will advance the closing funds which Bob will receive “in trust”. A conveyance is first registered in the name of Bob, and then immediately transferred to Bill, the beneficiary of the trust. While there is a second registration fee (under $100), there is no additional Land Transfer Tax.

This solution would also work for Mary, and would save the second Land Transfer Tax, if they were not married.

Agreements “with recourse” and “without recourse”

An Amendment Agreement or an Assignment Agreement can be negotiated on the basis of a “with” or “without” recourse arrangement.

Any arrangement whereby the original purchaser remains liable is “with recourse” and any arrangement whereby the original purchaser can no longer be sued by ABC is “without recourse”.

If you look at the standard Form ABC Condo Developers’ contract you will likely find the following provisions: “no assignments permitted without consent”, “ABC’s consent may be arbitrarily withheld”, and “should ABC consent, then the assignment fees must be paid in advance”.

Condo developers have found that the assignment market is active and they better agree to permit them in the first place, otherwise few investors will ever buy them. So, assignments are generally permitted. In some cases, the fee is nominal, only a few hundred dollars to facilitate the paperwork and in other cases a little more substantial, ie. $5,000.00. In those cases, they are making some money. The original buyer remains liable. But, ABC recognizes that most buyers are not close friends or relatives like Mary, but are truly arms-length purchasers. So, Bob should be let off the hook and the new purchaser should take over. In these cases, this is often arranged for an increased assignment fee, ie. something in the $10,000.00 plus range.

If ABC had sold 200 units and 100 of them were being resold, ABC by agreeing to the assignments with a $10,000.00 fee would generate an additional $1,000,000.00 for the project. And, that is just by filling out a few forms.

It should also be noted that investors are more likely to pay more for these units right at the outset. Confronted with a “no assignments ever building” and ABC’s assignment agreement fee, an investor might be prepared to consider the ABC building when it first comes on the market. Here, ABC may even add a slight premium to the purchase price. Again, a $10,000.00 premium would not be unusual, particularly for the higher priced units. But here, the additional premium is incorporated into the purchase price. So, all 200 units pay this premium and another $2 million finds its way to the bottom line.

So, if you are a condo developer, you should really like assignments. It’s a money maker and goes right to profits.

* caution, there are HST issues, and income tax issues for purchasers withdrawing funds from RHOSP’s, investors relating to capital gains and all parties related to the Land Transfer Tax and applicable rebates. Be sure to obtain proper tax and legal advice when entering into any transaction. Consult your accountant or your lawyer or solicitor practising real estate for guidance.

Brian Madigan LL.B., Broker