By Brian Madigan LL.B.

This may not be as far-fetched as it seems! Well, of course there’s a catch, but you don’t have to buy a lottery ticket.

All you have to do is pay your bills on-time.

Let’s consider the case of Bob, the general contractor. He pays his bills just shortly after they are due. He’s a pretty busy guy getting up at 5:45 am and to the jobsite before 7:00 am. Most evenings he’s out of the house doing estimates, and when he’s home, he’s mostly on the phone lining up his sub-trades for the next day. In fact, like the average consumer, he pays his bills seven times per year and a few of the accounts are just slightly over 60 days.

All the suppliers are happy to do business with Bob because he’s a good worker and he pays his bills. But, what is this doing to Bob’s credit? His credit rating drops from R1 (under 30 days), to R2 (under 60 days), and even to R3 (under 90 days) in some cases. When it comes to a mortgage loan, Bob qualifies but at a slightly higher rate than the best available rate. Over the last 25 years, this would have averaged about 3 1/2% per annum.

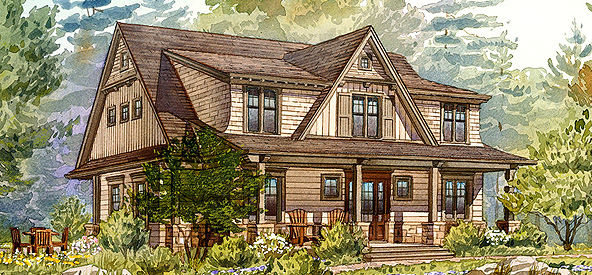

Let’s assume that Bob had a $ 200,000 mortgage. He paid about $100,000.00 more in interest for 25 years than needed. But that’s only half of the story. If he were to have invested the funds and secured a rate of return (after tax) of about 5%, then he would have had an additional $ 175,000. So, all in all, this slightly less than perfect credit rating ends up costing Bob $ 275,000.00. And, do you know what? That was more than enough to purchase a waterfront cottage in the Muskokas. OK, I appreciate that you’re not going to have Goldie Hawn and Eric Lindros as neighbours, but it’s still very nice to have.

What is the solution? Pay your bills just before they are due. Instead of sitting down seven times a year, sit down twelve times a year. Be scrupulous about your credit rating. Pay attention to the interest rate the mortgagee wants to charge you. Shop around for a better rate. If you are given a higher rate, take a shorter term, repair your credit and go back in eighteen months for a better rate.

What difference does it make? Well, in 25 years you could have a nice waterfront property in the Muskokas for the difference, perhaps not on the best lakes, but there are lots of smaller lakes too.

NOTE: This original post was written 15 years ago, so the numbers worked out. I did have a client just like Bob. He decided to take my advice , and in 18 months purchased a cottage for $300,000. That same cottage is now worth $1,200,000.00. So, that’s the rest of the story!

Brian Madigan, LL.B., Broker